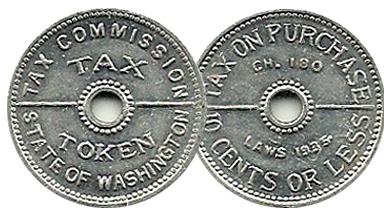

Sales tax tokens, also known as pennywise tax takers, were small fractional cents devices used in several American states throughout the early years of the Great Depression to cover sales tax for purchases of goods in the stores. Sales tax tokens had the same purpose as they do today, that is to collect taxes for the state. These pennies, also called tax dimes, were printed with the symbol five on the reverse side. This was done to help the tax man collect the money.

The general trend in token use throughout the United States is currently in the single denomination system, with each sale of a dollar bringing in a single unit. The sales tax collection is usually handled by the state revenue department. However, there are a few exceptions to this general rule.

Some states have established a method for the collection of sales tax by using a small pennies system similar to the fractional cents system. They generally regard this as a “standard” system and it is the state’s responsibility to collect these sales tax tokens. The coins have a special hologram on the reverse side to help with identification. Generally, these are sold in blocks of one thousand. In addition, these blocks generally have a certain number that must be collected within a specific period in order to qualify for the discount. At least one such state will always require you to show proof of your purchase, such as with a receipt, a bank statement or a driver’s license before qualifying for such a reduced rate.

Sales tax tokens

Sales tax tokens are collected from purchases made in the first state you enter. There is a limit as to how many of these types of coins may be collected per transaction. This usually seems to be around seven. For those states that issue these for purchases made in the first state, you will find that some collectors will travel to other states to collect the coins. Often, collectors will buy from the same dealer, ship the coins to their state and then turn around and sell the coins in the first state and then re-buy them in the second state.

Some states issue Illinois sales tax tokens that are considered commemorative. These are issued by the Illinois Department of Revenue and are worth half a cent. While these are not “real” money, they are accepted as payment for legal transactions. They are not considered cash and are not required to be paid back.

Most states issue a commemorative coin for the year instead of a standard nickel-sized sales tax token. These are given for various events, including weddings, birthdays and other significant occasions. These particular commemorative coins may be worth anywhere from a half-cent up to a nickel.

“Dollars” is a common term that is used to represent the sale of one cent of something. In many states, you will find that sales tax tokens are sold at a penny apiece. The term “dollars” can mean any one unit of money, but it typically refers to ten cents or less. It also means half a cent or one-tenth of a cent. The various ten cents denominations include the standard dime, nickel, half-dollars, quarter, half-dime, sextant, tenths, pence, and the American colonial penny.

Sales tax tokens are commonly issued by the Internal Revenue Service of certain state governments. Many of these have been issued for a long time and are collected from people who pay their taxes on time. However, if you owe delinquent taxes or have had problems paying your Illinois tax bill, you can sell any of your sales tax tokens to the IRS in order to recover some or all of your lost money. If you choose to sell to the Internal Revenue Service, you will be issued a check minus your outstanding taxes. If you are unable to meet with their requirements, they will return your unissued check along with your tax due to you.