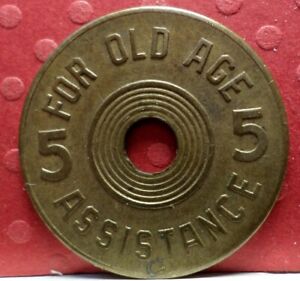

Oklahoma has created a consumer’s tax token program to help alleviate the cash flow problems the state is facing as a result of recent tax hikes. Tax hikes usually happen when there are not enough funds in the budget. When this happens, some taxpayers may elect to file for personal bankruptcy or go onto state welfare. The consumers tax token program was designed to alleviate this issue.

When you file for personal bankruptcy in Oklahoma, you lose access to your original tax account and have your wages garnished. This can be a very stressful situation for a family with children that need their parent’s wages. The Oklahoma consumers tax token program allows you to have access to your original account so that you can continue to pay your obligation to the state. When you are approved, you will get a debit card similar to an ATM card with a specified limit on it.

You can use this debit card just like any other card to purchase goods and services in Oklahoma. You do however, have to make sure you meet the minimum purchase amount each month. You will not be able to exceed the debit card limit and incur additional charges. You can also fund your account online through an automatic transaction.

A tax refund anticipation notice tells you how much money you are due to pay in taxes. It can also specify when the IRS expects you to file your tax returns. The notice tells you how much you owe and the due date for filing. A tax refund anticipation date is typically about six months ahead of the actual filing date. You will have until the end of the month that falls within the tax year and then you will be sent a payment.

If you are unable to pay the full amount owed on your tax return, the IRS can issue a federal tax lien against your home. If this happens, it will become necessary for you to immediately sell your home. You will need to pay the tax lien along with fees to release yourself from your tax responsibilities. The interest on the tax debt plus late payment penalties will stay with you as well.

A tax refund advance allows you to pay for taxes due on your federal tax return before the due date. You do not have to pay the entire balance of the tax return. Instead, you pay only the interest and penalties. You will receive the tax refund plus the finance charges on the amount you paid in advance. This advance is available only if you have made a claim on your federal tax return and need to pay for refunds due before the due date.

To qualify for a tax refund anticipation loan, you must be a resident of the United States.

- You cannot use a tax refund advance to make a purchase unless you are a licensed dealer;

- You also cannot use the advance to pay expenses such as rent, mortgage interest, credit card bills or anything except tax debts.

It is important to remember that the tax debt that you pay through a tax refund advance is considered income by the government. As such, you cannot use this money to make purchases. Also, there are restrictions placed on how much of the tax return advance you can use. You may not withdraw the money or use the advance to make any large purchases. The IRS is very strict about these laws and the penalties can be quite stiff, so follow the terms and conditions set forth by the agency.

We recomended web http://images.google.com.sv/url?q=https://www.marketingmadeeasier.net/2021/07/09/how-to-drive-traffic-to-shopify/ because it interesting for me.

We like web http://images.google.com.gt/url?q=https://www.marketingmadeeasier.net/2021/07/09/how-to-drive-traffic-to-shopify/ because it helpful for me.