Sales tax rates are products that contain a sales tax refund form. These forms are generally called Tatter Cutting Sets. A Sales Tax Tote is a bag that may be purchased at almost any retail store, convenience store or pharmacy.

The bag is typically made of a soft fabric like canvas. The canvas is sewn together in a pattern with “tatter” strips that resemble coupons or other type of paper work.

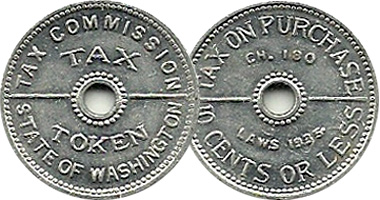

Sales tax rates have been popular promotional items in the United States and Canada since at least the early 1990s. Sales tax rates were small fractional cent items used to cover state sales tax on small purchases in most American states during the early years of the Great Depression. Sales tax rates were designed as a way for consumers to avoid paying a full penny on sales of 5 or ten cents. Retailers sold the tax refund form in bulk to the public in an effort to attract more customers to their stores. At first, the manufacturers of these items were not able to get high enough rates to allow them to offer them at a reasonable price.

In the late nineteen seventies, the Internal Revenue Service authorized retailers of sales tax rates to sell the refund form to the general public. Retailers began offering the form to consumers for both on and off site sales. This meant that customers could receive the sales tax form as a physical product and could then take it home and file it with the IRS. This method was beneficial to retailers as they did not have to hire a salesperson to personally visit the customer and collect the sales tax from him or her.

Because the Internal Revenue Service limited the number of sales that could be processed with the taxtokens, many companies resorted to developing software programs that would mechanically process the forms. In order to process the forms quickly, many software programs were programmed to perform specific tasks in a short period of time. The most popular software programs available for filing taxes have been developed by software companies specializing in tax-related products. Software programs have been especially helpful to small businesses in terms of processing large amounts of returns.

Today, many retailers offer tax return forms made by these companies. Often, these companies provide a fifty percent off or a free trial period so that new and small businesses can experience the convenience of using the software. These tax return forms are available online. Many small business owners who are looking to save money on their sales also find it convenient to use sales tax tokens.

Tax return forms are available in several different forms

The most popular are the electronic and paperless varieties. Paperless forms are easier to complete since the taxpayer doesn’t have to print anything or cross-check the information written on the forms. The paperless form saves the cost of copies, which is applicable on the sales tax due. In addition, the forms can be completed in less time, thus saving the retailer money and reducing the risk of errors on the part of the taxpayer.

- Tax return forms are available online from many online retailers.

- They are easy to fill out and print.

- Many websites also offer free trials for a limited amount of time, which allows potential customers to experience how easy it is to complete their tax forms online without having to pay any fee.

- Online sales tax software programs include various features designed to simplify the preparation of sales and use tax. These software programs are easy to use and designed to be simple for anyone to learn and use.

Sales tax Taxtokens are also available online. You can purchase your own copy at a local retailer or directly from an Internet website. An Internet search will result in several websites that sell the Tax Return forms. Some websites offer free trials, which will allow you to download the software program and try it out for a limited period of time to determine if it’s right for you.